Irs Form 941

Advertisement

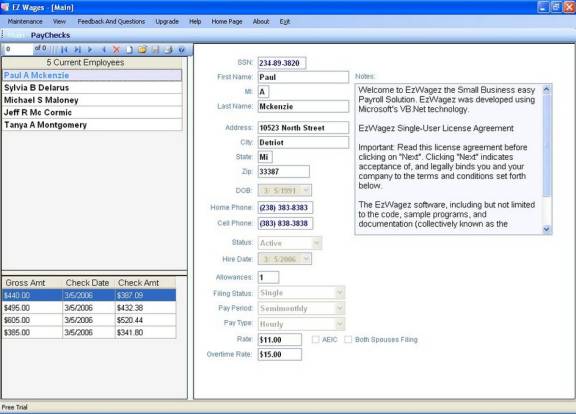

EzWagez Payroll System v.2.0.1.6

Small business payroll system developed using Microsoft's VB.

Advertisement

Print Lost W2 1099 Irs Forms & Paystub v.4 6

Print Old or Lost IRS W2's or 1099 forms For Free! Make Past and Present Paycheck Stubs, W2 & 1099-MISC IRS Tax form INSTANTLY. Make Your Copy Fast With Our Free and Easy To Use Online Payroll Software. Print Custom IRS Tax Forms INSTANTLY.

AcQuest 941 Solution 2012 v.1.00

AcQuest Programming Solutions is pleased to publish the 941 Solution 2012.

Free PayStub W2 1099 Paycheck Generator v.8.23.10

Download Our Free Small Business Income Documentation Generator. Calculate Create and Print Employee Pay Stub PayCheck Stubs IRS W2 and 1099 Forms Fast With Our Free and Easy To Use Online Payroll Software.

Backdated W2 1099 Paycheck Stub Maker v.4 6

Download Our Free Small Business Income Documentation Generator. Print Current & Backdated Employee Pay Stub PayCheck Stubs IRS W2 and 1099 Forms Fast With Our Free and Easy To Use Online Payroll Software. Print Custom IRS Tax Forms INSTANTLY.

AcQuest 1065 Solution 2004 v.1.00

AcQuest 1065 Solution 2004 is designed to run on Windows 95, 98, Me, & XP. It will prepare the four pages of federal Form 1065, U.S. Return of Partnership Income, K-1's, Sch D, 4562, 4797, 8825,

AcQuest 1120 Solution 2004 v.1.00

AcQuest 1120 Solution 2004 is designed to run on Windows 95, 98, Me, & XP. It will prepare the four pages of federal Form 1120, U.S. Corporation Income Tax Return, Sch D, 4562, 4797, & Deprn Schs,

AcQuest 1120S Solution 2004 v.1.00

AcQuest 1120S Solution 2004 is designed to run on Windows 95, 98, ME, & XP. It will prepare the four pages of federal Form 1120S, U.S. Corporation Income Tax Return for an S Corporation, K-1's, Sch D, 4562, 4797, 8825, & Deprn Schs,

1099-SA v.1

File Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA, to report distributions made from HSA, Archer MSA, or Medicare Advantage MSA (MA MSA).

1099-R v.1

A Form 1099-R is generally used to report designated distributions of $10 or more from pensions, annuities, profit-sharing and retirement plans, IRAs, and insurance contracts.